Case Study:

- Couple on $85k each

- 50/50 ownership of investment property

- $500k Investment property

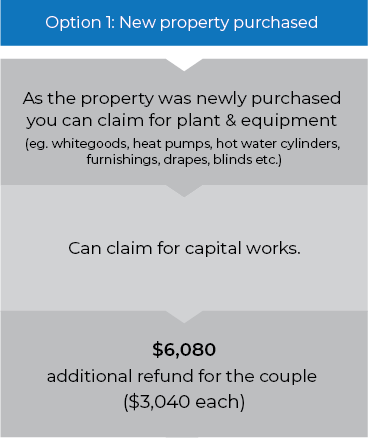

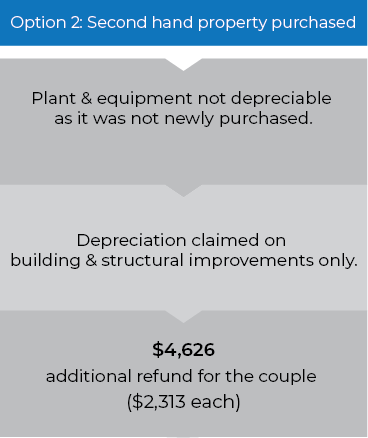

- Tax depreciation schedule prepared (this enables you to claim depreciation on the building, plant & equipment)

- Cost of the depreciation schedule is tax deductible

- The report is valid for up to 40 years, enabling us to claim depreciation each year for the life of the assets.

- Depreciation on plant & equipment can only be claimed on 2nd hand properties acquired before 9/5/21.

Residential Property

Hot water systems, heaters, solar panels

Air-conditioning units

Blinds and curtains

Light fittings

Swimming pool filtration and cleaning systems

Security systems

And More!

Commercial Property

Carpet and flooring

Desks

Blinds

Shelving

Manufacturing equipment

Commercial ovens

And More!

It's that easy. Save thousands of dollars each year by claiming your deductions